Buyers will be pinched by FHA’s new rules.

By Robert Freedman | March 2010

No one likes it when changes to mortgage underwriting make it harder for working households to secure safe and affordable home financing.

But in the case of the FHA’s tightened lending requirements announced in late January, the end may justify the means. The policy changes are designed to shore up the FHA’s capital reserves and help the agency do a better job of managing risk.

“These changes, while serious, are reasonable,” says John Anderson, CRS®, GRI, a 30-year real estate veteran who chairs the NATIONAL ASSOCIATION OF REALTORS®’ Federal Housing Policy Committee. “I think the FHA is doing the right thing.”

Nonetheless, Anderson, broker-owner of Twin Oaks Realty Inc. in Crystal, Minn., acknowledges that many households will be adversely affected. Buyers will have to either spend more to secure financing or scale down what they buy.

Among other things, the FHA is raising its upfront mortgage insurance premium to 2.25 percent from 1.75 percent, boosting the minimum down payment to 10 percent for borrowers with a credit score of 580 and below (it stays at 3.5 percent for everyone else), and reducing permissible seller concessions from 6 percent to 3 percent.

The FHA also will seek legislation to raise the annual mortgage insurance premium to a level above the current cap of 0.55 percent. The agency already has authority to institute the other changes.

“Striking the right balance between managing the FHA’s risk, continuing to provide access to underserved communities, and supporting the nation’s economic recovery is critically important,” FHA Commissioner David Stevens said in a statement.

Read the rest of the article here.

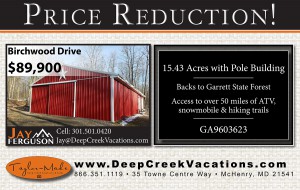

If you are thinking of buying or selling real estate in Garrett County or Deep Creek Lake, Maryland, call Jay Ferguson of Railey Realty for all of your real estate needs! 877-563-5350